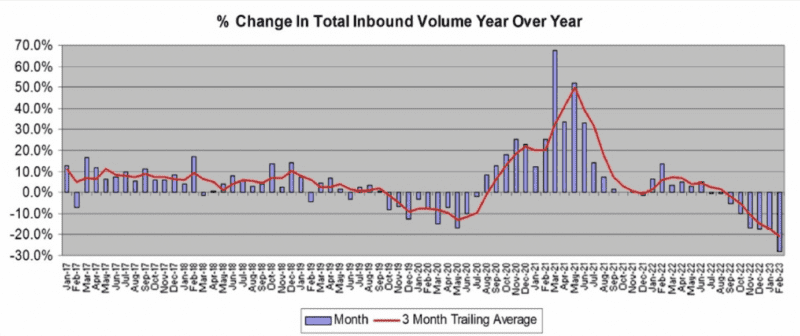

The top ten container ports in the U.S. had a their biggest monthly decline on record in February, reflecting the dramatic boom-to-bust cycle caused by the COVID-19 pandemic.

Inbound container volumes to the U.S. declined a “staggering” 28% last month, a “major deterioration” compared to January’s 17% drop and the fifth straight month of double-digit percentage declines, liner industry veteran John McCown says in his latest U.S. ports report.

“The tough comparisons to what were unprecedented year over year increases last year is now producing unprecedented year over year decreases and this will continue for a few months months at least,” McCown writes in his report.

The boom-to-bust cycle can be seen in the chart below showing year over year percentage changes in U.S. container imports.

McCown points out that February’s volumes are equivalent to a negative 1.4% compound annual growth rate (CAGR), or average growth rate over time, compared to pre-pandemic levels in February 2019 and only a positive 1% CAGR going back to 2017 before any impacts from former President Trump’s trade war tariffs on China. “Both rates are well below the 3.8% ten-year CAGR in annual inbound loads from 2010 to 2020 that excludes the pandemic induced gains,” McCown says.

Once again East and Gulf Coast ports outperformed West Coast ports in terms of percentage change in February—a 21-month streak—as ongoing West Coast port labor negotiations continue to contribute to inbound volumes shifting eastward, according McCown.

There was some good news for exporters in February as outbound volumes increased 4.6% on the heels of double-digit gains in January and December. “Outbound volume growth actually outpaced inbound volume growth for the seventh straight month after 26 months of under performance,” McCown’s report says.

McCown concludes his report by addressing “misinformation” related to pricing levels and trends in container shipping and maritime supply chains. He explicitly points to the New York Fed’s Global Supply Chain Pressure Index (GSCPI), which he says provides “flawed barometer” due in part to its use of spot indices which don’t accurately depict the container shipping industry.

As gCaptain reported earlier this month, GSCPI’s latest reading shows global supply chain pressures decreased considerably in February and actually turned negative (the lowest reading since August 2019), suggesting that conditions in the global supply chain have returned to normal.

“The correlation to a spot index that is neither a relevant measure of actual inflation in the container sector nor a measure of supply chain pressure is a strong indictment of the GSCPI. The GSCPI is now giving the false positive that supply chain pricing is lower than pre-pandemic levels,” McCown says.